Financial Risk Analytics

Learn market risk optimization and credit risk modeling through free Financial Risk Analytics course

Instructor:

Dr. Abhinanda Sarkar

Ratings

Level

Learning hours

Learners

Skills you’ll Learn

About this Free Certificate Course

Financial risk analytics is an evolving function in the financial sector due to the increased responsibility in the risk analytic that not only provides solutions that pertain to hedging the risk management techniques, but also the financial risk analytics. This course also helps us learn more about credit risk, market risk, regulatory risk capital, and advisory valuation adjustment.

This financial risk analytics course covers analytical techniques involved in risk and investment management and their course not only focuses on a core financial risk analytics concept across all types of financial risks including pricing, valuation hedging, and risk analytics across various assets. There are many types of financial risk analytics involved which we will be learning. This is a free course and you will receive a certificate upon completion of the same.

Great Learning also provides various postgraduate courses in domains such as Artificial Intelligence and Machine Learning. You can take up the Artificial Intelligence Courses and upskill. You will learn from the top leaders in the industry and attend dedicated mentorship sessions that will help you gain a comprehensive understanding of the concepts in Artificial Intelligence. You can also learn the latest tools and technologies in the industry that will aid in your professional career. These courses are designed to cater to your needs whether you are a working professional, a senior professional, or a fresh graduate. Upskill today.

Course Outline

Our course instructor

Dr. Abhinanda Sarkar

Faculty Director, Great Learning

Dr. Sarkar’s publications, patents, and technical leadership have been in applying probabilistic models, statistical data analysis, and machine learning to diverse areas such as experimental physics, computer vision, text mining, wireless networks, e-commerce, credit risk, retail finance, engineering reliability, renewable energy, and infectious diseases, His teaching has mostly been on statistical theory, methods, and algorithms; together with application topics such as financial modeling, quality management, and data mining.

Dr. Sarkar is a certified Master Black Belt in Lean Six Sigma and Design for Six Sigma. He has been visiting faculty at Stanford and ISI and continues to teach at the Indian Institute of Management (IIM-Bangalore) and the Indian Institute of Science (IISc). Over the years, he has designed and conducted numerous corporate training sessions for technology and business professionals. He is a recipient of the ISI Alumni Association Medal, IBM Invention Achievement Awards, and the Radhakrishan Mentor Award from GE India

What our learners enjoyed the most

Skill & tools

60% of learners found all the desired skills & tools

Ratings & Reviews of this Course

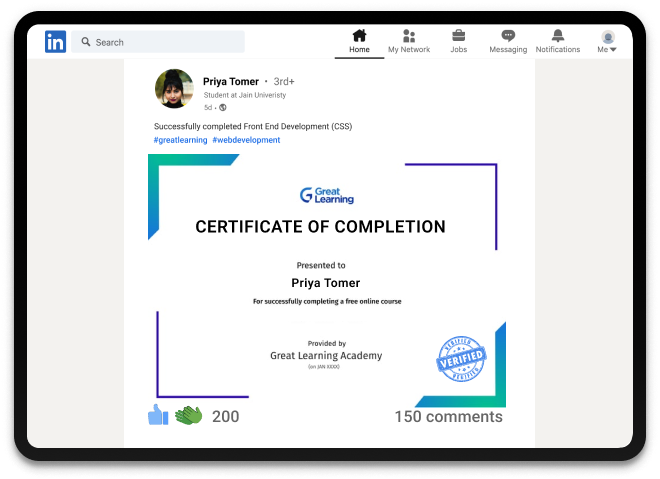

Success stories

Can Great Learning Academy courses help your career? Our learners tell us how.And thousands more such success stories..

Frequently Asked Questions

What is Financial Risk Analytics?

The range of solutions that provide risk analytics to financial institutions for measuring and managing their counterparty credit risk, market risk, and regulatory risk capital and derivative valuation adjustments.

What is an example of Financial Risk?

Financial risk generally relates to the risk of losing money. Such risks include liquidity risk, credit risk, foreign investment risk, equity risk, and currency risk.

Can I learn financial risk analytics for free?

Yes, one can learn financial risk analytics for free at Great Learning Academy.

What are the causes of financial risk ?

Financial risk usually arises due to the instability and losses in the financial market which is caused by movements in currencies, stock prices, varying interest rates and more.

How do you learn credit risk modelling?

You can learn credit risk modelling with Great Learning Academy’s free course in financial risk analytics.